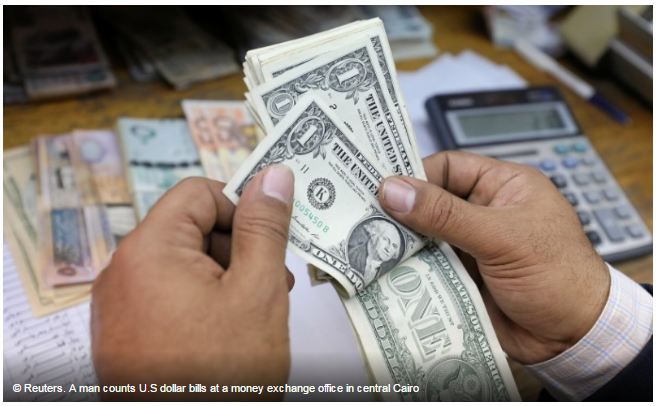

TOKYO (Reuters) – The dollar started the week at three-week highs against a currency basket on Monday, after a key U.S. Federal Reserve official reinforced the central bank’s commitment to interest rate hikes.

The dollar index, which tracks the greenback against six major rival currencies, added 0.1 percent to 101.260 (DXY), reaching out to its highest levels since March 15.

New York Fed President William Dudley said the Fed might avoid raising interest rates at the same time that it begins shrinking its $4.5 trillion bond portfolio, prompting only a “little pause” in the central bank’s rate hike plans.

His comments bolstered U.S. Treasury yields and burnished the dollar’s yield allure. The benchmark 10-year yield, which wallowed at its lowest levels since November on Friday, last stood at 2.384 percent (US10YT=RR) in Asian trading, up from its U.S. close of 2.373 percent.

“Rising interest rates in the U.S. are supporting the dollar, I think,” said Masafumi Yamamoto, chief currency strategist at Mizuho Securities in Tokyo.

Financial markets were also watching out for developments in the Syrian civil war following last week’s U.S. missile strikes on an air base in Syria, which had given the perceived safe-haven Japanese currency a boost.

The U.S. attacks were in retaliation for what it said was a chemical weapons attack on civilians by President Bashar al-Assad’s forces. The strikes drew sharp criticism from Russia, and questions from U.S. allies about future policy.

“Geopolitical risk can be a potentially positive factor for the yen, with risk aversion and flight to safety,” Yamamoto added. “As for the euro, markets are pricing in uncertainty around the French presidential election.”

The dollar tacked on 0.3 percent to 111.43 yen <jpy=>.

Geopolitical tensions in Asia were also in focus, after the U.S. decision to move a Navy strike group toward the Korean peninsula following provocative behavior from North Korea. White House national security adviser H.R. McMaster said on Sunday that the move was a “prudent” step.

U.S. jobs data on Friday missed forecasts but still suggested that overall labor market strength remained intact. Job growth slowed sharply in March amid inclement weather, and as layoffs continued in the retail sector, but the unemployment rate dropped to a nearly 10-year low of 4.5 percent.

Despite expectations for more Fed interest rate hikes, speculators further trimmed their bullish bets on the U.S. dollar in the week ended April 4, pushing net longs to their lowest level since late February, according to Commodity Futures Trading Commission data released on Friday and calculations by Reuters.

The euro edged down 0.1 percent to $1.0580 <eur=>after earlier touching $1.0570, its lowest level since March 9.

For weeks, polls have shown centrist Emmanuel Macron and far-right leader Marine Le Pen on track to top the first round of voting on April 23 and go through to a May 7 runoff. But recent polls have shown the race tightening.