Currencies

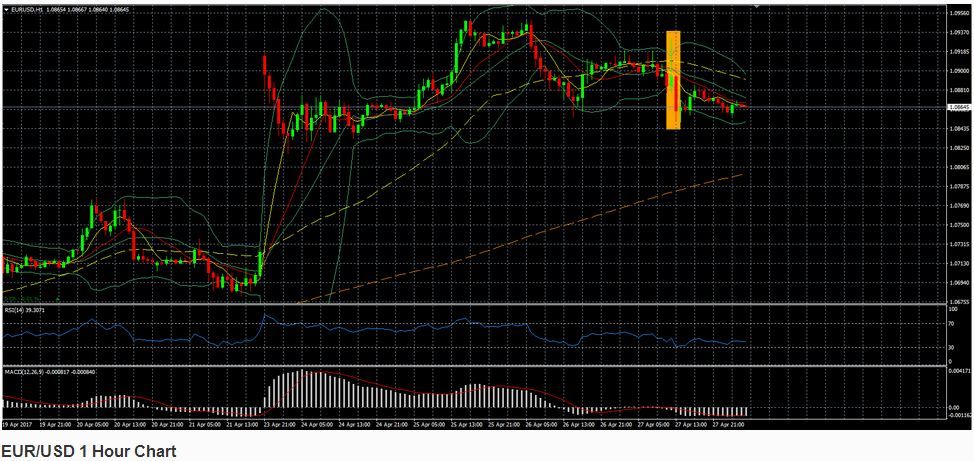

EUR/USD – As expected, the ECB played a large role yesterday and we saw large swings in the EUR/USD rate with a fluctuation of over 80 pips in 2 hours. After the decision was released that there was no change in the interest rate and that QE would continue as planned at a rate of €60 billion per month until the end of the year we saw the EUR weaken a bit. However, at the start of ECB President Draghi’s press conference, the EUR strengthened as he struck a more optimistic tone, saying that even though there are still downwards risk, these have diminished.

The economic data and confidence have improved since the last meeting although inflation remains lower than desired. The EUR reversed course again after Draghi confirmed that the ECB did not discuss raising the interest rate and that the interest rate will remain at the present level or even lower if necessary.

Today we will have inflation data out of the Eurozone as well as GDP data out of the US.

USDJPY- is moving slightly down as it Is having some trouble around the mid 111 level at the moment. The data out of Japan this morning was a bit mixed, not giving any clear direction, although inflation remains a clear issue, underscoring that the BOJ said yesterday. While there has been a serious winding down of safe haven positions after the first round of the French elections and also because the situation with North Korea didn’t escalate further, we still have to pay attention to that. President Trump has said in an interview that a large war with North Korea is a possibility although he would prefer a diplomatic solution.

USDJPY- is moving slightly down as it Is having some trouble around the mid 111 level at the moment. The data out of Japan this morning was a bit mixed, not giving any clear direction, although inflation remains a clear issue, underscoring that the BOJ said yesterday. While there has been a serious winding down of safe haven positions after the first round of the French elections and also because the situation with North Korea didn’t escalate further, we still have to pay attention to that. President Trump has said in an interview that a large war with North Korea is a possibility although he would prefer a diplomatic solution.

GBP/USD – has reached the 1.29 level again as indicated a few days ago that we were likely to see another attempt to reach that level after we saw nice support around the 1.277 level. We will wait to see what the GDP data out of the UK will show on the state of the economy.

USDCAD– after President Trump indicated that instead of withdrawing from NAFTA he would try to renegotiate the treaty, the CAD strengthened and reached the support (previously resistance). It was able to find support and was able to reverse the entire decline as the CAD weakened on a further decline in oil price and also is still reeling from the import tariff of lumber by the US as also the USD strengthened.

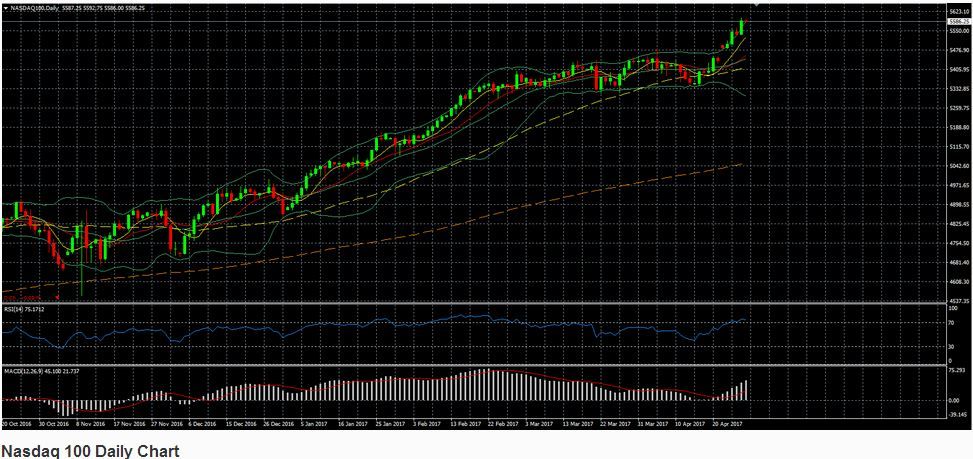

Nasdaq 100 – keeps on posting record after record as the earnings overall remain very solid, especially in the tech sector.

Nasdaq 100 – keeps on posting record after record as the earnings overall remain very solid, especially in the tech sector.

S&P 500 – moved up marginally as most sectors were in the green, but the energy sector weighed heavily and as a result it was outperformed by the Nasdaq. The new tax plan was not able to really move the markets higher and neither did the news that President Trump will try to renegotiate NAFTA instead of withdrawing from it straight away. We will wait for the GDP data today and also to see if the US government will be able to pass a spending bill to prevent a government shutdown.

S&P 500 – moved up marginally as most sectors were in the green, but the energy sector weighed heavily and as a result it was outperformed by the Nasdaq. The new tax plan was not able to really move the markets higher and neither did the news that President Trump will try to renegotiate NAFTA instead of withdrawing from it straight away. We will wait for the GDP data today and also to see if the US government will be able to pass a spending bill to prevent a government shutdown.

Commodities

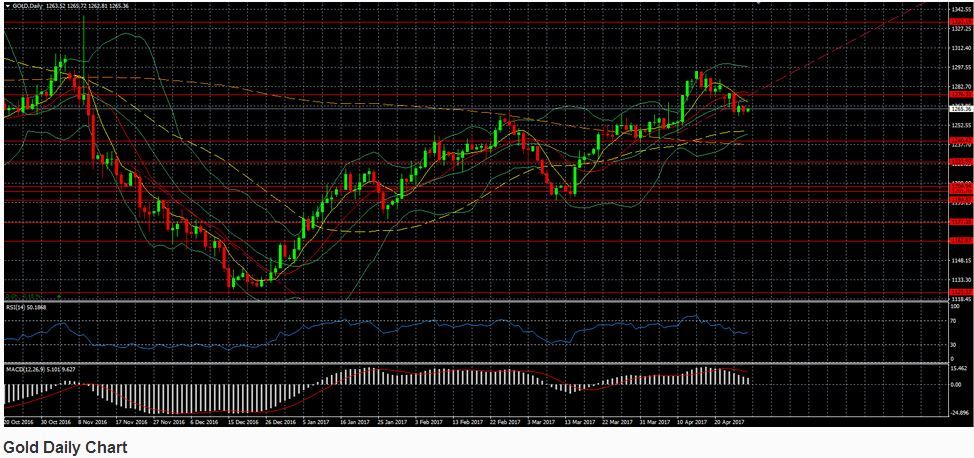

Gold – dropped as the USD strengthened and because equities keep on rising, lessening the need for a safe haven. However, President Trump has said in an interview that a large war with North Korea is a possibility although a diplomatic solution is obviously preferred, so that remains in focus as well. In the meantime, though we are seeing some sort of support forming around the 1260-1263 level as that has been the lowest level over the last few days. The GDP data today and also the possibility of a government shutdown in the US are likely to influence gold today.

Oil – oil saw another large drop and reached the lowest level in a month, even though it pared part of its losses later in the afternoon. The reason for the drop is that Libya will be reopening its largest oil field as a blockade that was in place since earlier this month will end and thus is expected to increase production. Libya is one of the countries that is exempt from cutting or freezing production under the OPEC agreement and thus can produce as much as it can. At the moment it is waiting on a clear direction from OPEC, which will decide next month whether to extend the agreement, which likely will happen. However, it remains to be seen how effective that will be as until now it barely had any impact in dealing with the oversupply as inventors remain near record highs and US production keeps increasing. We will be looking to see if the number of active rigs in the US increases as well, as it has for the last few months.

Oil – oil saw another large drop and reached the lowest level in a month, even though it pared part of its losses later in the afternoon. The reason for the drop is that Libya will be reopening its largest oil field as a blockade that was in place since earlier this month will end and thus is expected to increase production. Libya is one of the countries that is exempt from cutting or freezing production under the OPEC agreement and thus can produce as much as it can. At the moment it is waiting on a clear direction from OPEC, which will decide next month whether to extend the agreement, which likely will happen. However, it remains to be seen how effective that will be as until now it barely had any impact in dealing with the oversupply as inventors remain near record highs and US production keeps increasing. We will be looking to see if the number of active rigs in the US increases as well, as it has for the last few months.