US indices closed lower this week, but not by much. SPX lost just 1% and is just 3% from its all-time high. A number of notable short-term extremes in sentiment, breadth and volatility were reached on Thursday that suggest equities are at or near a point of reversal higher. The best approach is to continue to monitor the market and adjust with new data. That said, it’s a good guess that SPX still has further downside in the days/weeks ahead.

Our last several posts have emphasized several points:

Strong uptrends (like this one) weaken before they reverse, meaning the current sell-off is unlikely to lead directly into a major correction.

Even years with powerful returns (like 2013) experience multiple drawdowns of 3-8% along the way, meaning the current sell off was due and is perfectly normal.

There are a number of compelling studies suggesting that 2017 will continue to be a good year for US equities, meaning equities will likely end the year higher.

Read more on these points here and here.

SPX ended the week at 2328, 3% off it’s all-time high (ATH) made on March 1. That is a very mild drawdown. Our post last week argued that a sell-off to at least the 2300 area (4% off the ATH) was likely. From that respect, a lower low is likely to still lie ahead. That post is here.

There were a number of notable short-term extremes in sentiment, breadth and volatility reached on Thursday that suggest a rebound in equities is ahead. Let’s review these.

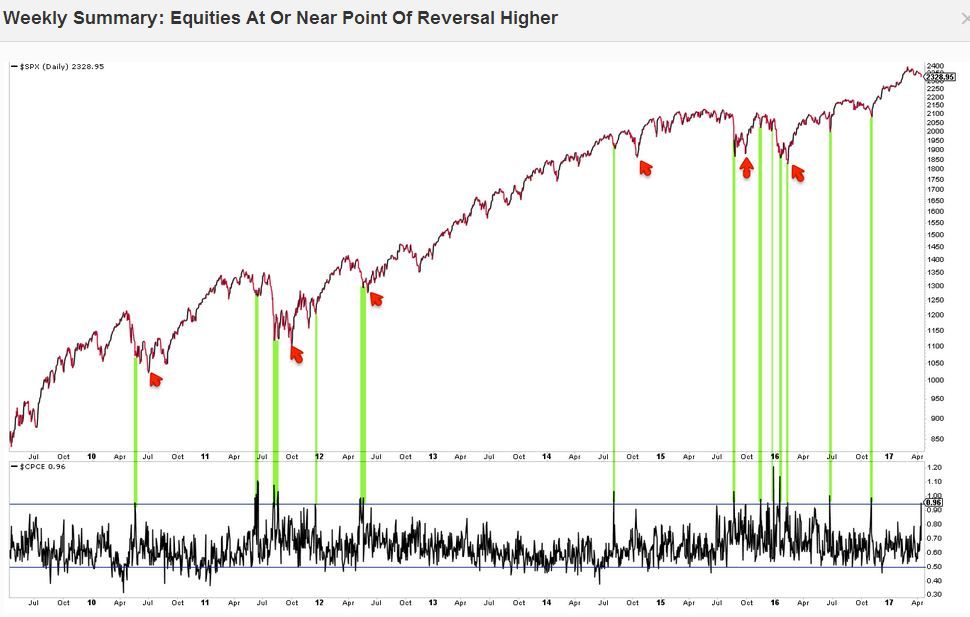

First, the equity-only put/call ratio reached a rare extreme on Thursday, with nearly as many puts as calls being traded on the day. That has happened only about a dozen times in the past 8 years. All of these have been at or near a short-term low in SPX (green lines). A rebound is likely ahead. That rebound might not last long, however: note that in several instances, the low was retested or exceeded in the days/weeks ahead (red arrows). Enlarge any chart by clicking on it.

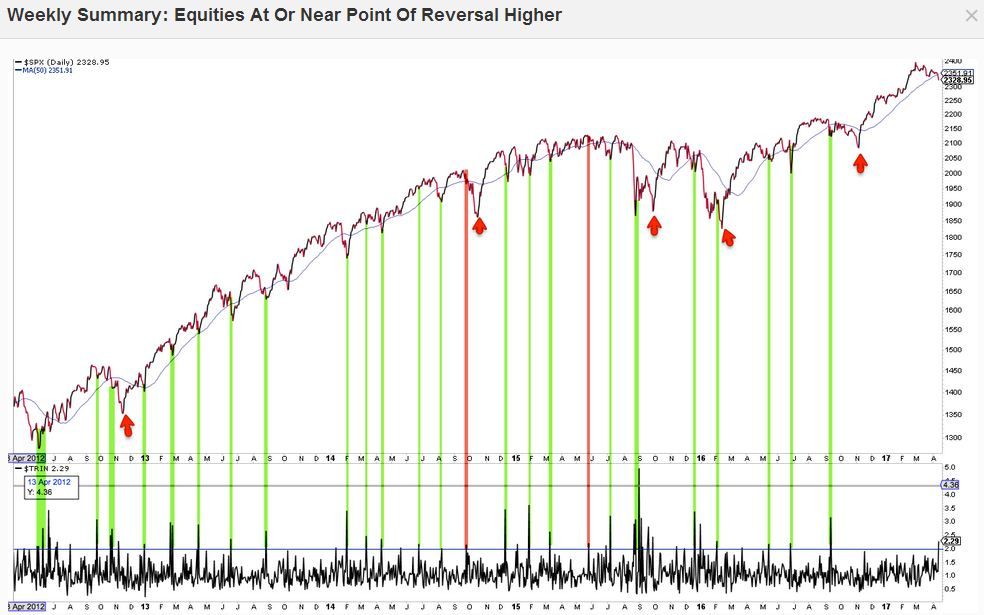

Second, Trin (also called the Arms Index) closed above 2.0 on Thursday. Trin is a breadth indicator derived by dividing the advance-decline ratio for issues by that for volume. A close over 2 means that down-volume was twice down-issues; in other words, stocks fell on relatively high volume.

A spike higher in Trin such as that on Thursday can often be near a low in equities. That is particularly true when the spike higher in Trin has occurred after several days of selling, like now. In this case, a high in Trin marks capitulation. A relevant post on this indicator is here.

Similar spikes in Trin over the past five years are shown below. A rebound is likely ahead. But, like the put/call ratio discussed above, that rebound might not last long: note that in several instances, the low was retested or exceeded in the days/weeks ahead (red arrows). Take last September as an example: SPX rebounded to its 50-dma (blue line) before falling further into the November low.

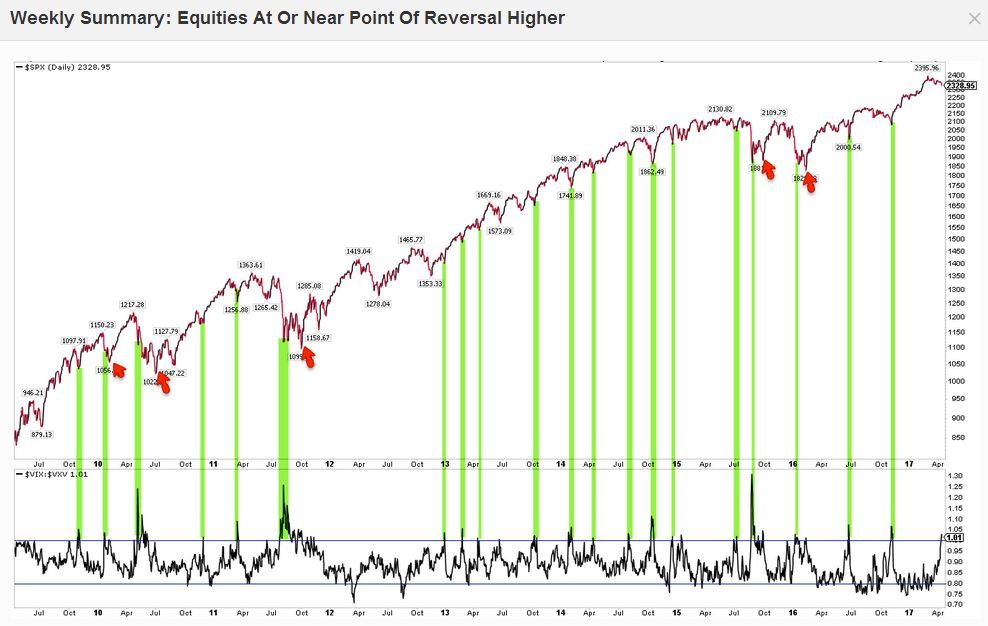

The third short-term extreme reached on Thursday was in the volatility term structure: when one-month protection (via VIX) is trading at a premium to three-month protection (via VXV), equities have been at or near a point of reversal higher. Similar instances over the past 8 years are shown below (green lines). Like the other two studies above, it is notable that the low was retested or exceeded in the days/weeks ahead in several instances (red arrows).

When the volatility term structure is in its current configuration and SPX is also near a 52-week high, equities have been higher 2-4 weeks later in all cases except one over the past decade (from Dana Lyons).