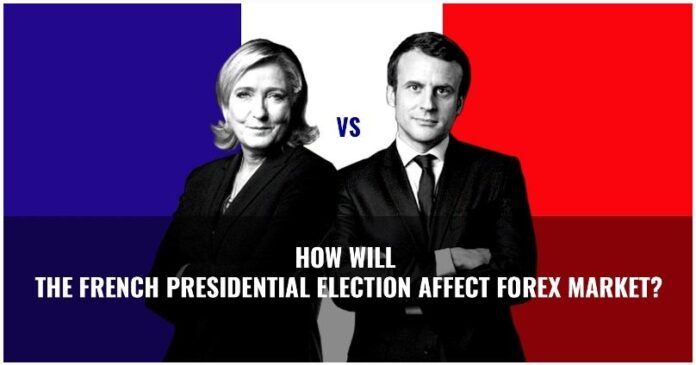

Time is ticking, French Presidential Election is knocking on doors and this Sunday, French citizens will have the upper hand as they will decide the EU coming future. For once and for all, Frexit will either re-surface or lay to rest depending on the final outcome this Sunday, May 7th 2017. Bare in mind, whoever wins, there will be consequences on the financial market in general, but euro will take center stage.

Two candidates ( Macron and Le Pen ) have qualified for the final round, and latest polls indicate that Macron is ahead by 60% and Le Pen is behind by 40% taking into consideration that Fillon who came third in the first round has requested his supporters add their voices to Macron, and Melenchon as left-wing voters are committed to prevent Le Pen from claiming the rein. But that’s election, and nothing is guaranteed, and if we go back a bit in history to U.S elections, polls gave Clinton the priority, and markets saw Trump’s triumph as shocking. So below, we will place the possible scenario and the outcomes despite what polls are signaling and indicating although their is one major difference, the gap poll between Macron and Le Pen is way wider than the gap poll that was between Clinton and Trump.

Scenario one ( Macron Winning the French Election):

Market is already priced in on the fact Macron is winning, and during the first round, as Macron was heading the polls, euro gaped upward, hitting five months highs, and if Macron is officially declared a president, optimism will increase further more pushing euro to higher levels with 1.10 or 1.11 as target. Macron calls for a sharper Pro-EU tone and sees EU as a whole nation, which should push EU stocks and CAC40 even higher. On the other hand, gold gapped downward and later on fell by $30 as political tension seemed to fade away.

Scenario two ( Le Pen winning the French Election ):

Before we discuss what will happen to the market, first lets briefly state what Le Pen stands for. Le Pen represent the total opposite of Macron and sees France as an independent nation, calling for a referendum by French citizens to vote for a departure from european Cartel following the path of UK voting for Brexit. We all remember what happened on Brexit and how the euro and British Pound was on a roller coaster. If Le Pen was declared winner, then fear will creep into minds and gossips about Frexit will be on the French menu. Take at that, euro will start the process of depreciating gradually with 1.600 and 1.500 as target as early signs. The more Frexit approaches and becomes a reality, markets could witness even lower levels than 1.500. european stocks will plunge as well CAC 40, and the biggest winner will be gold as geopolitics play its role in pushing the yellow metal into higher levels for 2017, being a sacred-haven substitute.

French presidential candidate Marine Le Pen crossed the wires last minutes today, via Reuters, noting that Italy would welcome her efforts to renegotiate the euro, in case she wins the election.

The below fourth and fifth scenarios are less likely to happen, but part of analysis, it’s our duty to include all possible outcomes.

Scenario Three: It’s never about who wins:

It’s never about who wins despite the fact Le Pen or Macron being victorious. The fact the France has a new president will push euro higher. During U.S elections, market and analysts were divided with different opinions on how will the market perform and will happen to U.S Dollar taking into consideration what Clinton and Trump, each of them stand for. The fact there was a president in the oval office boosted U.S Dollar and American Stocks rallied, add to that, Dow Jones hit new records. Taking at this, we could see a possible scenario on the short run, but as time narrows down with each president agendas (long run), we will see how euro and EU Stocks will perform depending on impact level of each president agenda.

Scenario Four: Market is already Priced in that Macron is a Winner:

This is the least possible scenario. Market has placed its bets that Macron is a winner, and has traded on this fact. The optimism is expired, euro and EU Stocks has already peeked as if France is staying in the EU, so it will bring nothing new to traders mind. EUR and EU Stocks will stay put and even make a minor correction upward or downward. Later economic data will shape up the Forex market including euro, EU Stocks, and CAC 40, depending on the outcome (Economic Data) as part of ebb and flow between currencies.

আশা করি আর্টিকেলটি আপনার ভালো লেগেছে। এই আর্টিকেল সম্পর্কিত বিশেষ কোনও প্রশ্ন থাকলে আমাদের জানাতে পারেন কিংবা নিচে কমেন্ট করতে পারেন। প্রতিদিনের আপডেট ইমেইল এর মাধ্যমে গ্রহনের জন্য, নিউজলেটার সাবস্ক্রাইব করে নিতে পারেন। গুরুত্বপূর্ণ বিষয়গুলো টিউটোরিয়াল দেখার জন্য অনুগ্রহ করে আমাদের ইউটিউব চ্যানেলটি সাবস্ক্রাইব করুন। এছাড়াও, যুক্ত হতে পারেন আমাদের ফেইসবুক এবং টেলিগ্রাম চ্যানেলে। এছারাও ট্রেড শিখার জন্য জন্য আমাদের রয়েছে বিশেষায়িত অনলাইন ট্রেনিং পোর্টাল।